Actor Hill Harper said it perfectly: “Credit card interest payments are the dumbest money of all.”

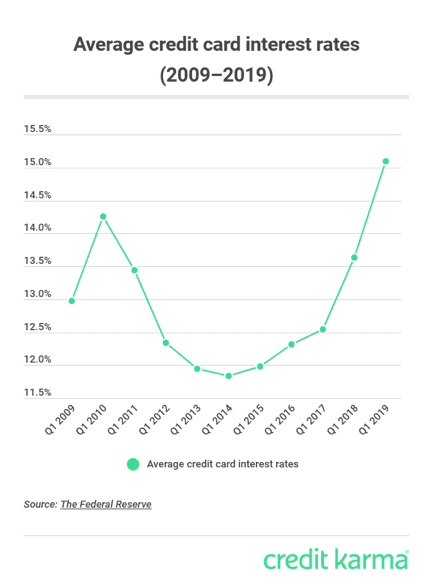

This year wasn’t kind to credit cardholders’ wallets. In 2019, cardholders paid an average of 17% APR – the highest level recorded by the Federal Reserve since 1994. To put it into perspective: in 2009, the average APR registered just under 13% and in 2016 it hovered around 12.5%.

(See chart below)

Even the maximum APR has climbed significantly. Financial institutions typically over a wide range of APRs. As a result of the increase, maximum APRs are around 25% with the media standing at 21%.

Even the maximum APR has climbed significantly. Financial institutions typically over a wide range of APRs. As a result of the increase, maximum APRs are around 25% with the media standing at 21%.

So, what does this mean for you?

Well, it means you’re likely paying more in interest than you’ve ever paid. But, don’t worry. There are several ways around paying high interest rates that will actually help you in the long run.

Avoid balance carryover

Ultimately, the best and most responsible way to use a credit card is to pay off the balance monthly. By paying your balance in full each month, you avoid paying interest while reaping the benefits a credit card has to offer. Plus, it helps improve your credit score.

Avoid spending more than you have

We’ve all done it. We have a credit card for emergencies only, but something comes up we really want, and it finds its way to the credit card. Next thing you know, there are multiple unnecessary purchases on there that you’re trying to pay off. The best habit to get into is not spending more than you can pay off monthly. The more you put on a card, the more interest you’re going to be charged.

Do your research

If you’re thinking about signing up for a credit card, do your research. First of all, know your credit score. That’s going to be a huge factor in determining your APR. Also, consider why you want a credit card. Are you looking for cash back options? Do you want to earn points or airline miles? Don’t wander and apply aimlessly. Look at the specific types of cards that are designed for the purpose you want and see which card best suits your needs.

Obtaining and maintaining credit by using credit cards doesn’t have to be a scary experience. Have you talked to someone at Secured Advantage Federal Credit Union? We have several types of credit cards that could fit your needs.

Before you go with a big box bank, talk to us and see how we can help. Stop by a branch or call us today.